This is part four in a series about 4 Frameworks To Grow To $100M+. Subscribe to get the rest of the series.

- In the introduction to this series, I explained there are two types of companies: Tugboats, where growth feels like you have to put a ton of fuel in to get only a little speed out, and Smooth Sailors, where growth feels like wind is at your back. The difference between these two are not the common mantras of build a great product, product market fit is the only thing that matters, or growth hacking.

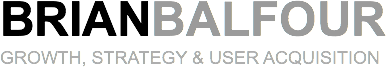

- In part two, I talked about why we should think about Product Market Fit as Market Product Fit, how to lay out your Market and Product hypotheses, and how understanding whether you have Market Product Fit comes down to Qualitative, Quantitative, and Intuitive indicators.

- In part three, I covered Product Channel Fit - that products are built to fit with channels, channels are not built to fit with products.

Which brings us to part four, Channel Model Fit.

Channel Model Fit

Channel Model Fit is simple - channels are determined by your model.

First, what do I mean by “Model?” The two most important elements of your model are:

- How Your Charge - For example, free (monetized with ads), freemium, transactional, free trial, one year up front, etc.

- Average Annual Revenue Per User - What the average $$ you make from a customer/user per year.

A common question I get at this point is: “Why only look at average annual revenue versus full LTV?”

The reason is because most startups need to keep their payback period to less than one year. If it is much longer than one year then you will need a lot more cash to fund growth. This is a catch-22 because companies that are growing fast are able to raise a lot of cash, but if you need a lot of cash to grow fast (i.e. high payback periods) you will never show the momentum to raise the money needed.

Let's return to the definition of Channel Model Fit, that channels are determined by your model, and look at why that is.

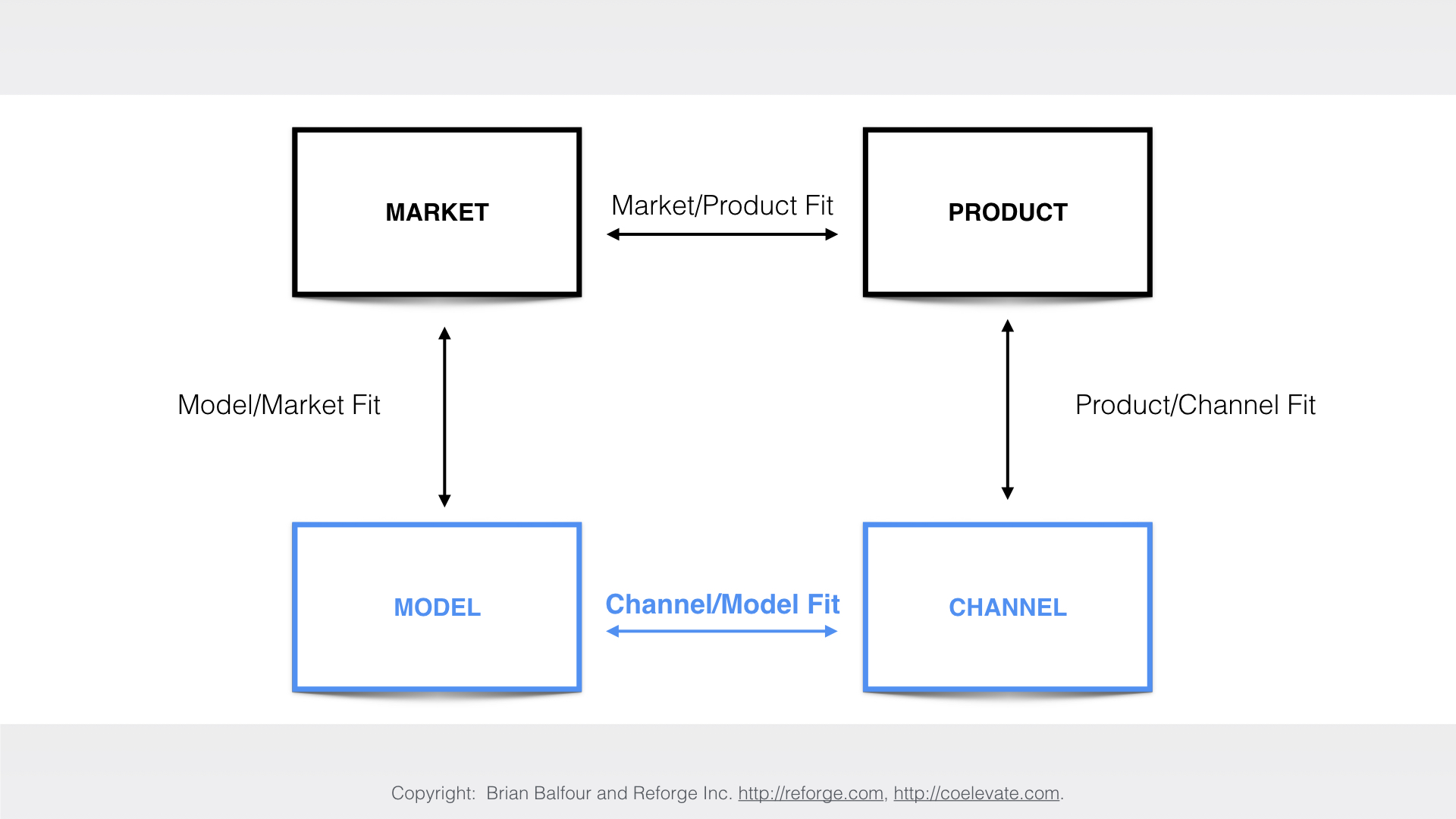

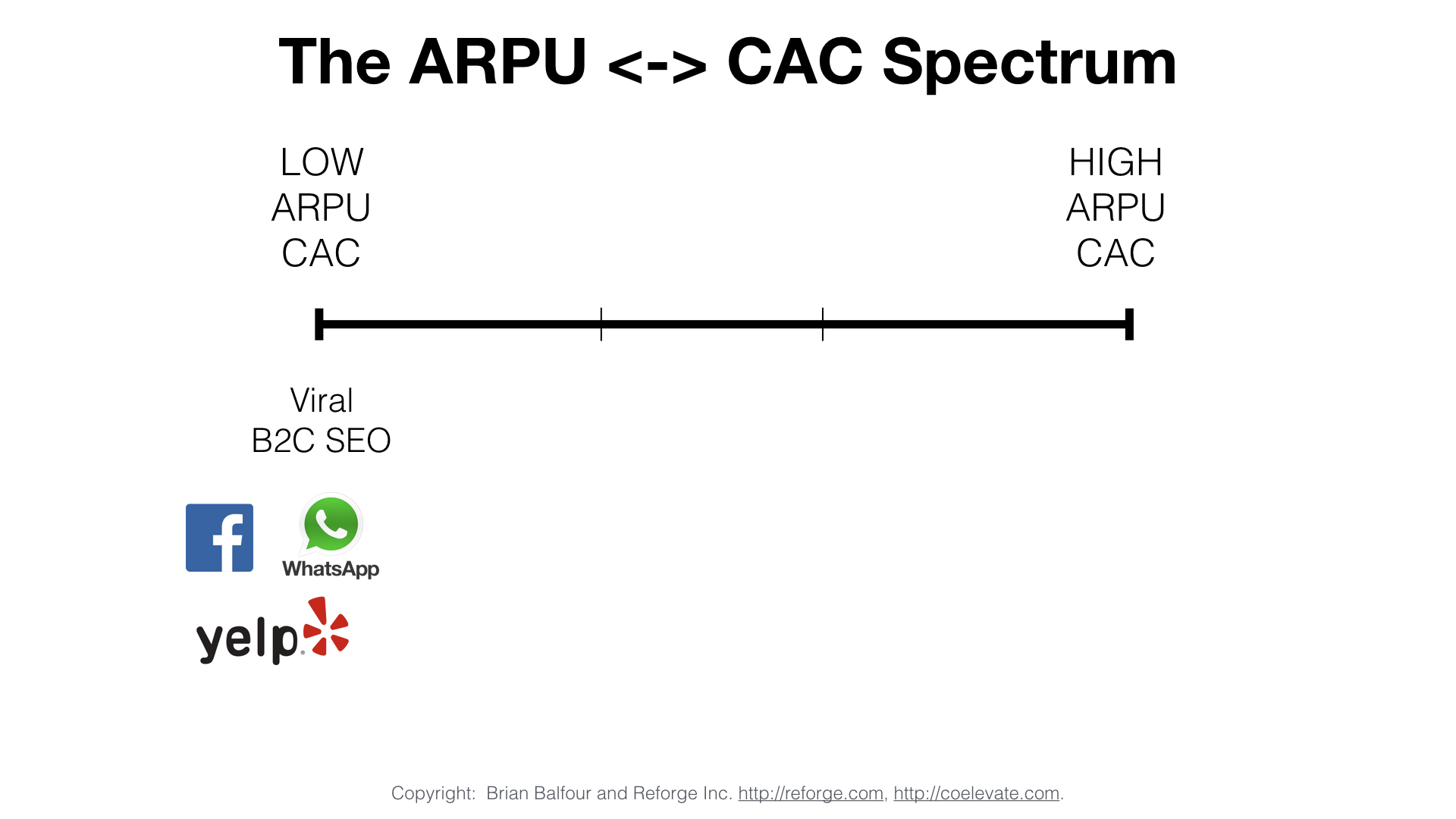

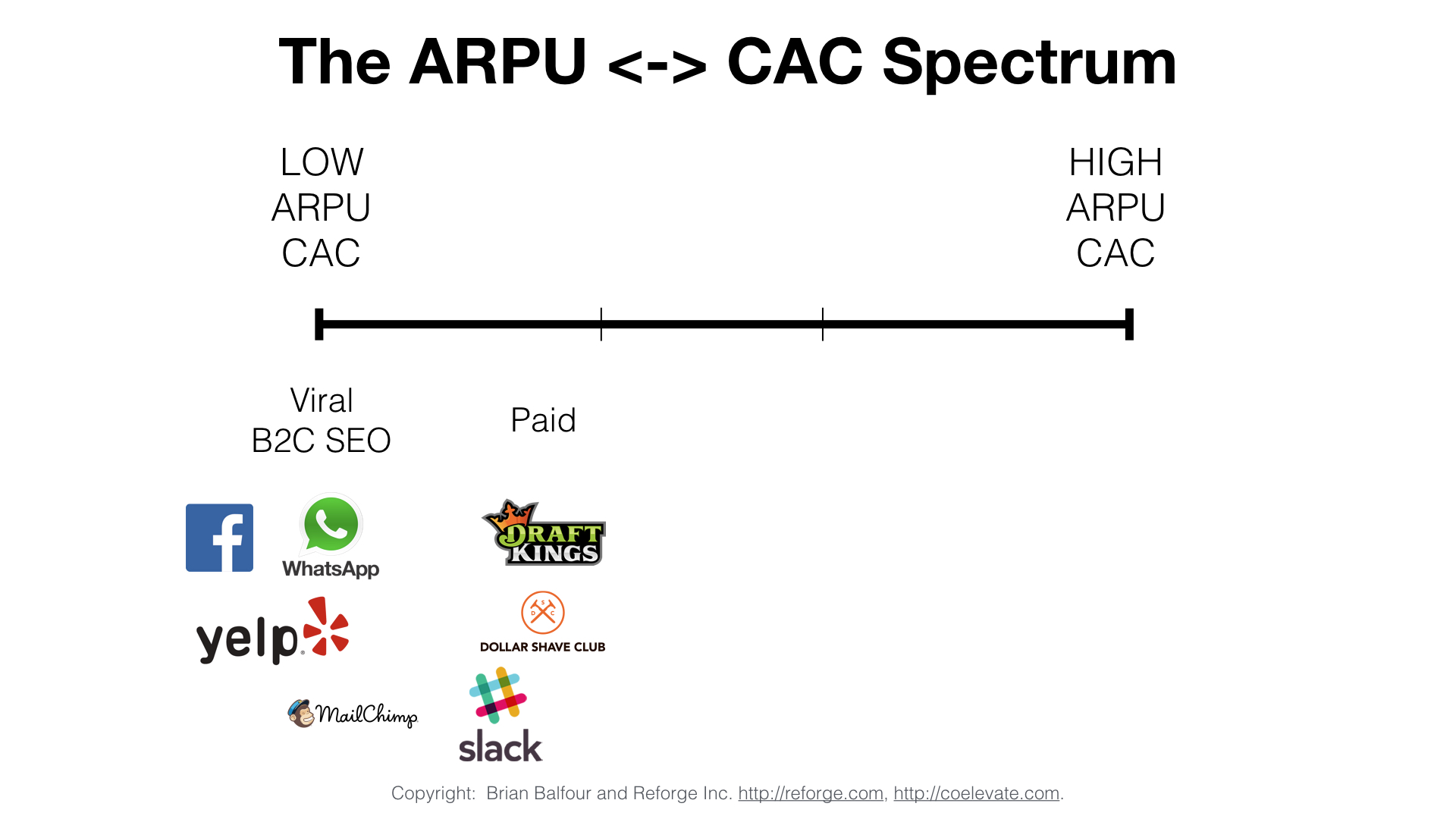

The ARPU <-> CAC Spectrum

Every business lives on the ARPU ↔ CAC Spectrum. On far left you have businesses that have low ARPU and as a result have to use low CAC channels to drive customers. On the far right you have businesses that have high ARPU and as a result are able to use high CAC channels. I'll walk through some examples:

Most B2C companies driven by an ads model — companies like Facebook, WhatsApp, and Yelp — live on the left hand end of the spectrum. They have low ARPU, and therefore have Product Channel Fit with low CAC channels like Virality and UGC SEO.

One step over on the spectrum you have slightly higher ARPU businesses. Think of something like Dollar Shave Club or DraftKings. Businesses with transactional models (i.e. subscription e-commerce) typically live here. Because they have higher ARPUs they can take advantage of higher CAC channel like Paid Marketing.

In the B2B world you also have B2B products like MailChimp, Slack, or SurveyMonkey that live on this end of the spectrum as they take advantage of viral and paid channels to drive most of their volume.

Shifting over to the right hand end of the spectrum you have higher ARPU businesses (typically B2B Mid Market companies) like HubSpot and Zendesk. They have higher ARPUs and can therefore take advantage of high CAC channels such as content marketing, inbound/inside sales, or channel partnerships.

Finally on the far right hand end of the spectrum you have very high ARPU businesses (6 to 7 figures) and therefore take advantage of very high CAC channels such as enterprise and outbound sales. Companies like Palantir and Veeva exist on the very far end.

The ARPU-CAC Danger Zone

If you notice above, I left the middle of the spectrum blank. This is the ARPU-CAC Danger Zone.

I call it the danger zone because companies that end up in this zone have a much higher failure rate because they lack Channel Model Fit. These companies' problem with Channel Model Fit can be broken down into two major reasons.

1: Too Much Friction For Low CAC Channels

Low CAC channels require low friction products (quick time to value) and low friction models. Companies in the danger zone have ARPUs that are too high and introduce too much friction to use low CAC channels.

For example, if you clicked on an ad for an interesting product and found it to be $500, what are the chances you would buy? Pretty minimal. The higher the price, the greater the friction. The greater the friction, the less effective the lower CAC channels are because they just don't influence a user's decision enough.

2: ARPU Doesn't Support Higher CAC Channels

Companies in the danger zone also have ARPUs that are too low to support the higher CAC channels. These companies end up with terrible unit economics as they're forced to shell out more than they can bring in with that spend.

Can Companies Exist In The Danger Zone?

The danger zone does not imply that a business can't exist there. You can have a business here, but your acquisition strategy ends up a patchwork of bits and pieces from a lot of different channels rather than owning one channel. Piecing together a lot of little channels is much more difficult to execute well, and ends up in slower overall growth. Over time, this can lead to the company's failure.

Tom Tunguz of Redpoint Ventures did a great analysis to show that there are companies that have succeeded in the “no man's land” of the ARPU-CAC Danger Zone. But Tunguz makes the key point that the analysis itself suffers from Survivorship Bias. If we were able to analyze all startups every created and classify them if they were in the danger zone, we would find a much higher failure rate.

The ARPU ↔ CAC Spectrum for Product Tiers

Channel Model Fit doesn't just exist for overall products and companies; it exists at a product tier level as well. LinkedIn is a great example of this.

- LinkedIn Free - On the left end of the spectrum they have their free product driven by Virality and UGC SEO. Low ARPU (advertising) therefore low CAC channels.

- LinkedIn Premium/Jobs - One step over they have LinkedIn Premium and LinkedIn Job Postings. Higher ARPU, therefore they can take advantage of higher CAC channels like Paid. They are in the advantageous position where they also own the channel.

- LinkedIn Talent, Sales, and Learning Solutions SMB - LinkedIn also has B2B products in Talent Solutions, Sales Solutions, and Learning Solutions for small and medium sized businesses. Here they use mostly Content Marketing and Inside Sales.

- LinkedIn Talent, Sales, and Learning Enterprise - They also have enterprise tiers of their B2B products and use outbound enterprise sales to drive those.

The fact that LinkedIn has been able to layer on multiple products with Product Channel Fit and Channel Model Fit is partially why they are worth $26B at the time of this writing.

Get these four fits to align for one product, and you have a $1B company. Get them to fit multiple times within your business and you likely have a $10B+ company.

Implications Of Channel Model Fit

There are two primary implications of Channel Model Fit:

1. Don't Treat Model and Channel In Silos - You can't think about your model and your channel in silos because the two go hand in hand. If you are making changes to your model (pricing, how you charge, etc.), you also need to consider your channel to make sure you still have Channel Model Fit. I see a lot of entrepreneurs make changes to pricing and expect the other components to continue working, but this kind of model-level change can make or break the viability of the key channels you've been counting on.

2. Don't Treat Channel Model Fit In A Silo - If your channel is determined by your model, but your product is built to fit the channel...see where I'm going with this? This is why you can't treat these fits separately and need to have working hypotheses for each.

In my next post we'll go through the fourth framework Model Market Fit. After that we will bring all four frameworks together and put them into action.

Comments