One of the most common discussions we have in Reforge is around cross-functional influence. It is one of the core challenges to crossing the canyon from senior individual contributor to manager in product, marketing or any function.

In-Depth Insights and Guides

About Customer Acquistion And Growth

One email per week, unsubscribe anytime with one click

Explore vs Exploit

The goal of testing a lot of growth ideas is not to find a lot of things that work.

The Traction To Growth Canyon

Momentum is everything in startups. Loops compound, which means losing momentum doesn't make things incrementally harder, it makes them exponentially harder. Maintaining momentum requires anticipating future problems, and making sure you are planting the right seeds today.

Overcorrecting As A Repeat Founder

There are a lot of advantages to being a repeat founder. It is often easier to attract talent and capital. You have pre-existing relationships you can leverage. You have less stuff you are figuring out for the first time. One thing I've reflected on over the past year though is how being a repeat founder can also lead to blindspots.

Great Companies Are Built On Great Technical Strategies

As we grow Reforge, we've started developing a line of programs for engineering leaders. The first was Scaling Product Delivery. Our most recent one is Technical Strategy, created by Harsh Sinha (CTO at Wise, ex-PayPal, eBay) and Bryan Dove (ex-CEO at Skyscanner, Eng Leader at Amazon, Microsoft).

I find this topic interesting because most of the time when people talk about strategy, they are referring to either company strategy or product strategy. But as Harsh and Bryan point out in How to Overcome the Technical Strategy Spiral, great companies our built on great technical strategy for a few reasons:

Great Tech Strategy Enables Speed

At the lowest level, engineering teams are making a million tradeoffs that either create future friction or future speed. A good technical strategy enables future speed for your organization. This means your company can get farther, faster than others.

All Defensibility Has Technical Roots

There are different types of defensibility, and all the long lasting ones are enabled by technical strategy. Zoom has differentiated on audio/video quality. It has separated them from a crowded space. This was enabled by deep technical strategy. Data network effects in products like Pinterest or Spotify are enabled by technical strategy around personalization.

"No matter what type of defensibility a company has, they need to keep innovating to maintain that moat and defend against competition. The best, hardest-to-cross moats are technology-driven. When tech leaders cannot participate effectively in creating these moats, companies lose defensibility."

Bad Tech Strategy Leads To Degrading Product Market Fit

In the Reforge Product Strategy program, Casey Winters (CPO at Eventbrite) talks about how Product Market Fit is not static:

"The expectations of the customer continue to increase and change over time, and in fact, total satisfaction is likely an asymptote impossible to achieve. So what is product/market fit then? Product/market fit is not when customers stop complaining and are fully satisfied. They’ll never stop complaining. They’ll never be fully satisfied. Product/market fit is when they stop leaving. Represented visually, customer expectations are an asymptote a product experience can rarely hope to achieve, but product/market fit is a line a product can jump over and try to maintain a higher slope than over time." - Casey Winters, Reforge Partner and CPO at Eventbrite

In other words, product-market fit requires more work just to maintain over time. If a company does not have engineering leaders good at technical strategy, they rack up the wrong kinds of technical debt and, as a result, can't focus on continued innovation and improvements.

One Foot In The Known, One Foot In The Unknown

My first job out of college was as a Product Manager at ZoomInfo. By all measures I was a terrible employee when I started.

I entered into a situation where 90%+ of what I was suppose to work on were things I knew nothing about. As a result I struggled to make progress on anything. I wish I had something like the Product Foundations program at the time.

Thankfully, my manager at the time quickly recognized this, and we had a long honest conversation about what I was comfortable with and what I wasn’t. From there, he helped reshape the project so that a larger percent of the work was based on things I knew how to do while making sure a chunk was still new to me. That was a turning point for me. After that, I not only learned much faster but delivered much better results.

The common advice is to maximize learning, you should jump into something with both feet. This is wrong. Studies have shown that the most effective learners learn by relating the new with the known.

If you want to maximize learning and impact you need a foot in the known and a foot in the unknown. Whatever you are working on, a certain percentage of the work are things that leverage what you already know, and a certain percentage are things you don’t know and you need to stretch.

The Known vs Unknown Spectrum

We can think about this as a spectrum where one end is 100% known. This is where what you are working on only requires skills you've mastered. The other end is 100% unknown. This is where the work doesn't utilize any skills you've mastered.

Both ends of this spectrum are problematic.

When you are too far in the known you aren’t continually learning. If you stay in this zone for too long it leads to your knowledge and capabilities becoming obsolete as the industry moves around you. Being in the known can often be the source of being bored or unhappy with your job. It’s easy to fall too far into the known because it feels easy, comfortable, and efficient.

Being too far in the unknown also has its problems. It leads to being overwhelmed and not knowing where to start. This leads it to making it impossible to make progress and feeling like you are on a hamster wheel. This is where I was with my first job at ZoomInfo.

The Goals Is Not Maintain 50/50

While you might think that this means the perfect spot is to always be 50/50, in reality there is no perfect 50/50. What you want to shoot for is the range in the middle of 70/30 to 30/70. Sometimes you might be 70% in the known, and 30% in the unknown. Sometimes the reverse. Your goal is to recognize the signs when you are one of the ends of the spectrum and figure out a way to work yourself back to the middle. To do that typically requires changing or reshaping the project that you are working on.

Related Links: Impact = Environment X Skills, Grow Your Career Like You Grow A Product, 7 Principles To Mastering Growth

Scaling Emerging Acquisition Channels

In 2013, I wrote "How New User Acquisition Channels Drive Change." The core of the piece is that with every new major acquisition channel that emerges, we see massive new companies emerge with it. This has proven to be true time and time again.

But choosing, testing and scaling emerging acquisition channels is incredibly hard. For existing companies, they require a different approach than attacking mature channels for a few reasons:

🎲 Lower Probability of Success, But Much Higher Returns When Successful

By definition, if you wait until you are confident the channel will be huge, it is not emerging and the returns will be smaller. This means that companies have to look at "success" differently vs other efforts.

🧠 There Are No Experts To Hire

When a channel is emerging, there are no "experts" that you can hire to establish the channel for you. You need to hire an "explorer" who can be a different very profile vs the rest of your team. This is partially difficult because the best explorers are often founders.

Adam Grenier (ex-Uber, Hotel Tonight) and Scott Tousley (Head of User Acquisition at HubSpot), wrote one the most in depth piece on this topic I've seen: How To Choose, Test, and Scale Emerging Acquisition Channels.

They lay out a comprehensive framework to walk through this that:

Customer <> Channel <> Company Overlap

Evaluating the DNA of the Channel

Evaluating the Company DNA

Problem vs Opportunity First Approach

When I'm evaluating an investment for Long Journey Ventures, one of my favorite questions to ask is: "Out of all the things you could spend your time on, why this company?"

I've found that the answer to this question typically falls into two camps:

Problem Focused

The answer takes the shape of "I started experiencing X problem in some way, so I started to look for solutions and had the insight of Y." In this answer, there is some organic connection with the problem being solved.

One of the best examples of this I think is TJ Parker, the Founder/CEO of PillPack, one of the first D2C online pharmacies, which was bought by Amazon for $1 Billion. I wasn't lucky enough to invest, but I do remember meeting TJ early on and hearing his story about how both he and his dad were a pharmacist and that through working for his dad he had been intimately close with the problem of prescriptions.

Opportunity Focused

The second type of answer takes the shape of "I looked at the market and it's a huge business opportunity."

While I think you can build a successful company in either direction, my hypothesis is that those who are problem focused lead to a lot more massive businesses for a few reasons:

🎢 The Rollercoaster - Being a founder is a rollercoaster. When you are in a down moment, source of energy and motivation is stronger when it stems from the problem vs the opportunity.

🏅 Rewarding vs Fun - I recently tweeted about this. I often get asked "Are you having fun building Reforge?" Honestly, no. It's not "fun." Vacation with my college buddies if fun. I do it because I find it challenging and fulfilling.

🟩 Green Grass - The number of tech companies is growing at a faster rate than the supply of talent. There are more and more opportunities for talented people. Which means, the grass often feels greener as a founder. There is always another idea, role, company, market, etc. that feels easier, more compelling, or more lucrative.

💡 Miracles + Insights - One of the Long Journey Partners, Cyan Banister (Investor in SpaceX, Uber, Niantic, and more) , talks about to build a massive business you typically need one or more miracles to occur. Miracles are problems that don't have a solution but if unlocked creates massive more value. Some times miracles occur by luck like catching a pandemic tailwind or some new emerging acquisition channel.

I myself have fallen into both of these camps through out my career. My first two venture-backed companies were opportunity focused. For example, my first company Viximo was in the social gaming space. I started that company because I learned about the virtual goods monetization model emerging in Asia and seeing the Facebook platform launch. It seemed like a great opportunity, but I wasn't into gaming or connected with the problems in any way and as a result the rollercoaster was tough to stomach.

Reforge on the other hand started with a problem. In 2015, I was working at HubSpot as the VP of Growth. Every week, a member of my team would ask me about professional development. What can I do to up-level faster? How can I get better at identifying problems in our growth strategy? Where can I look for tools to better my thinking around monetization? After hours of research and conversations with friends and colleagues, I found myself hitting dead ends. It made me feel like a terrible manager, but also tapped into a problem I had experienced many times myself. Reforge is already a much bigger business vs my initial companies.

System + Motivation = Growth

Thank you to Casey Winters (CPO at Eventbrite), Kevin Kwok (Mystery Thinker), Darius Contractor (CPO at Vendr), Luc Levasque (VP Growth at Shopify), and Brian Hale (CGO at DoorDash) who all in some way informed this quick take.

It's easy to get lost in the weeds when you are operating day to day on something. I commonly find this in conversations with Reforge Members and Long Journey Ventures Founders. I find it helpful to have simple foundational tools to return to in order to reset and focus your thinking. For growth, that is:

Growth = System + Motivation

Let's break this down.

The System → Your Growth Model

Your growth system helps you:

Answer and align around "How does the product grow?"

Informs the metrics that you should measure.

Identify your biggest points of leverage

The asset that describes your system is your growth model (qualitative or quantitative).

Once you know how the system works, you have three choices:

Optimize the current system - Reduce friction or add good friction.

Expand the current system - Expanding one of your growth loops.

Create a whole new piece of the system - Adding an entirely new growth loop.

These are ordered from easiest, but least impactful, to hardest but more impactful.

Motivation → User Psych Map

But knowing how the system works isn't enough. Why? Because there are human actors (customers, partners, etc) behind each step in the system. That means you need to understand the psychology of what motivates those humans.

The asset that describes those motivations is what we call a user psych map, which describes the "why" of the actor behind each action in the system.

Once you know the motivations, you have two choices:

Increase the motivation

Layer on new motivations

Overall, moving motivation can be even harder than improving the system but also more impactful.

Related Links: Psych Framework

Managing Up ≈ Managing Down

In "Managing Up - Lessons From Scaling Teams at Credit Karma and Lyft," Dor Levi (ex-EVP at Lyft), Valerie Wagoner (ex-VP at Credit Karma), Anne Lewandowski (ex-Product Lead at Apartment List), and Matt Greenberg (ex-VP Eng at Credit Karma) tackle the tough topic of managing up. Here are some highlights and added thoughts.

Managing Up is one of the topics that is critical to crossing the career canyon, but hard to tangibly grasp. It feels like a mystery skill. As a result, it tends to get confused or labeled with things like being political. Which is why I appreciated this more tangible approach:

"Managing up requires a similar approach to managing down."

There is a lot more understanding on managing down. So applying similar methods in a different direction is helpful. That comes down to three things:

Packaging Problems In A Way That Makes Helping Easy

"Good people managers avoid giving their reports poorly-defined problems that are beyond what they can handle. Similarly, good upward managers package problems in a way that takes their managers' constraints (e.g., lack of time, competing priorities) into account. When faced with a difficult situation, effective upward managers package the problem in a way that makes it easy for their manager to provide help.

Aligning Personal and Org Goals

"Good people managers find opportunities for direct reports to achieve personal goals (e.g., develop new skills, earn a promotion) in ways that also deliver results for the company. Similarly, good upward managers help their leaders achieve personal goals as part of their efforts to drive company goals. This requires clearly understanding your manager's goals and how they relate to the company's."

Building An Empathetic Approach To Working Together

"Good people managers understand what their reports need to do their best work, ranging from setting norms around working hours to establishing a sense of psychological safety and trust. Good upward managers take the same approach to working with their leaders taking into account things like preferred formats for information, scheduling, feedback, etc."

The team took on how to tactically implement these and more in the full piece.

Related Links: Crossing the Product Career Canyon, Crossing the Marketing Career Canyon, Impact = Environment X Skills

Data As A Strategic Lever Of Growth

Crystal Widjaja is former SVP Growth and Business Intelligence at Gojek, one of the largest super apps in Southeast Asia. Crystal helped Gojek scale from 20K orders per day to 5M. In a recent Reforge article, she talked about the most common questions around data in tech companies. Things like:

Should I hire a data engineer or a data analyst?

Do I need a data scientist right now?

What kind of analysis should the data team be doing?

Is the PM or data team responsible for data collection?

Should I be using Looker (an advanced data transformation and visualization tool)?

What’s the right ratio of analysts to PMs?

Where do analysts report into?

She says at the core of these questions is one root problem. It views data as a team to hire or set of tools to implement. If you take this approach, you almost guarantee getting to the wrong answer. Instead, you need to approach data questions from perspective that data is a strategic lever of growth.

Strategy → Stage → Team → Tools

Viewing data as a strategic lever of growth involves going through four areas:

Strategy - What are your points of leverage? How does data improve those points of leverage?

Stage - What stage of maturity is our product in? What stage of maturity is our Data in?

Team - What people do we need to achieve the data strategy? Are they set up for success internally?

Tools - What tools do we need to adopt to facilitate the team's impact?

Data Informed → Data Driven → Data Led

Crystal breaks this out into three major stages. Know which stage you are in informs which capabilities you should be focused on:

Stage 1: Data Informed. These companies are focused on building the business and getting to product-market-fit (stable user retention rates). The key business need is for data to provide operational visibility.

Stage 2: Data Driven. These companies have reached product-market-fit and are actively optimizing for specific users, behaviors, and experiences in the product at the feature-level. The key business need is for data to support the organization’s growth with scalable tooling, data products, and deep-dive insights.

Stage 3: Data Led. These companies are operationally run by data products, infrastructure, and services. The key business need is the “productization” of data services that unlock Product and Data Science teams, allowing them to automate operational decision-making and user product experiences.

Get all the details on this framework in her full post: Scaling Data: from Data Informed to Data Led.

Related Posts: The Data Wheel of Death, Why Analytics Fail, How To Drive Insights For Growth

Why Differentiation Is So Difficult

It seems like the default answer to every question is "build a good product." I hate that answer. It feels lazy to me and doesn't help teams decide what to do or change.

What "good" is in one situation isn't "good" in another. "Good" is different based on customer, market, value props, and overall strategy.

Let's think about the definition of "good" from the customer perspective. When they say "I use X product because it is better than Y", what are they really saying? My opinion is that they are expressing differentiation. The product is better on some value prop that is important to them vs others in the market.

The best product teams are able to narrow in on what the most important thing is for their customers and growth loops and over invest in that thing compared to all others in the space.

An Example From Zoom

I think a good example of this is Zoom. Zoom launched, competed and won a market where there were tons of both well embedded competitors as well as attempts at competition (even pre-covid).

If you pulled a Product Manager or Product Designer off the street, fired up the Zoom product and dashboard, and asked them to rate how good the product is, I imagine most would give a medium to low rating.

The design and usability of certain pieces are miserable. Want to add a user to your paid account? Here are the steps:

You have to find the users admin..

add the user

get a message that you don't have enough Licenses

then go find the billing part of the admin

know to click edit your plan

add licenses to your account

go back to the user admin and add them.

🤯 Painful to say the least. Alternatives to zoom have better UI, polling features, and a whole lot more.But here is the thing. It doesn't matter.

If you asked core customers of Zoom why they use Zoom over others, they will say something to the effect of "It just works" or the "Video/audio quality is better." That is because that's their differentiator and they've over invested in it compared to competitor's and alternatives. They've built infrastructure, desktop clients, and other product work that other's haven't specifically to improve the quality. In addition, in the Zoom Case in Reforge's Growth Series we talk about how not only the most important value prop to their customers, but it is also the thing that drives the most influential pieces of their growth model.

Why Differentiation Is So Difficult

So why is investing in differentiation so difficult?

Customer Feedback - Customers can't communicate how to invest in differentiation. Advances in differentiators aren't obvious. Customers in feedback will reach for the quickest solution they can think of in their mind which is typically something they've seen in a competitive product or alternative (which is literally the opposite of differentiation).

"The Unforseen" - The same thing exists with internal teams. As humans we tend to gravitate to things we can visualize more clearly. Investing in differentiation often involves leaning into something where there isn't as clear of a path and we have to trust that we can create it.

Trying To Repeat Past Successes - Along the same lines of doing what we know and can see is that product teams try to repeat what was successful in their past companies. But once again, differentiation and what a "good" product is changes with every situation.

The Gravity of Competitors - Be careful who you name as competitors internally. Teams will tend to pay attention to them and we tend to gravitate towards the things we pay attention to. One of the hardest product strategy questions to decipher is when to copy and when to ignore.

Depth Is Hard - Investing in differentiators requires you to go deeper on some vector than anyone else. Depth is just plain hard. Requires commitment, focus, solving problems others haven't, and so much more.

Related Posts: Alternatives, Not Competitors, Doing The Opposite

Doing Your Best Work

I unlocked a lot in my career when I figured out when and how I did my best work. Once I figured that out I then designed my environment to optimized for those things.

Here is one quick example. In my mid to late 20's I would often participate in live meetings where I felt like I wasn't contributing to my full capabilities. That would leave me feeling extremely frustrated which led to doing even worse work.

At some point I decided that I was going to block off time before an important meeting to prepare some thoughts. I'd sit down, dump my brain out on paper, then pull together the top structured thoughts. I came to those meetings with better contributions, questions, and clarity of communication.

What I realized out of this is that I do my best thinking through writing. I then figured out I did my best writing in the morning between 8am -11am after a short workout and coffee. I now have habits, rituals, and frameworks designed around these two things. A few:

I block my calendar every morning and defend it with my life.

I have writing rituals to help me work through problems I'm solving.

I have frameworks I turn to when I get stuck.

For the roles that work with me the most, I interview for this to make sure we are a fit.

Everyone is unique. Some people thrive off the live energy of a brainstorm and "talking it out." I didn't discover all of this until I was ≈30 years old. I posed the question on LinkedIn if this is something Reforge could help build to help others discover what works for them.

Tons of interesting responses. My favorite was from Fred Stutzman, CEO of Freedom where they've found in research that there is a wide variety of how people do their best work, but it falls into a few categories: Time, Place, Environment, Physiology, and Emotional State. This topic warrants a deeper essay, but thats for another time.

Product Systems

As a team grows, there are different teams with different charters they focus on. An immense amount of effort goes into clearly defining those charters, minimizing overlaps, setting success metrics and more.

But no matter what you do, everything is connected:

If you improve monetization, you might decrease retention or acquisition.

If you improve acquisition, you might decrease retention.

If you launch x feature, it can impact the usage of feature y and z.

In a recent Reforge Member event, Fareed Mosavat brought up a good hypothetical to explain this:

"Slack could probably run a pricing test that shows there is double the willingness to pay from current prices. A team might simply conclude we should double the price. But if they did that, it would probably kill or severely hinder the viral loops of the product which is a core part of the growth strategy."

While clearly defined charters, good success and tradeoff metrics, and solid OKRs can help, the effort that goes into them reach a diminishing return. These things are guardrails, but no guardrail is perfect. With enough effort and motivation, anyone can plow through the guardrail and drive off the cliff.

2nd Order Effects

Thats because products are systems. Every change you make has 2nd and 3rd order effects. The solution isn't better OKR's or more documentations but increasing the understanding and education among your team about the system so that thinking about the 2nd and 3rd order effects becomes intuition. Doing that starts with the leaders having clarity of how the system works.

Being "More Strategic"

In a recent conversation I had with Sachin Rekhi, he pointed out that when an individual is bad at this, it often takes the form of feedback "you need to be more strategic." But most individuals have a hard time understanding what that means. They interpret it as "I need to create the strategy" when what they should be doing is seeking to understand the strategy and operate better within it. Advancement in any function requires you to get good at understanding the strategy/system and making decisions within it before creating the strategy itself.

All products are a system. Seek to understand the system and the 2nd order effects of your decisions. Then you can drive impact.

Why We Raised $21M After Bootstrapping To An 8-Figure Revenue, Profitable Company

After bootstrapping Reforge for 5 years, we announced yesterday that we raised $21M from Andreessen Horowitz and a group of engineering, product, design, and other leaders. We didn’t need to raise. Reforge is an 8 figure revenue, profitable company. As a result, I’ve had a lot of people reach out asking why we decided to raise capital.

Raising capital is a big decision and one I know many founders face. I've now done multiple venture-backed and bootstrapped companies. I've regretted taking capital in some situations, and in others have zero regrets. So why did we do it?

My Views on Raising Money

I figured I would first share my views on raising money.

Capital is a means to an end, not the end itself

First and foremost, I view capital as a means to an end, not the end itself. It is easy to get caught on the treadmill of fundraising round to fundraising round. But I believe capital is just one of many tools you can use to help you build what you want to build. The questions that I think are more important are:

a. What do you want to build?

b. On what timeline do you want to build it?

c. What resources do you need to achieve a and b?

d. What are the different ways to get those resources?

With a lot of alternative methods of financing coming online, the answers to these questions are becoming more numerous. For Reforge, we were in a fortunate position to be able to fund our growth with the cash flow of the business for the first few years.

The best path is what you want, not what the industry wants for you

I find people tend to be dogmatic about what is "right." Either "You need to raise venture capital if you want to build a meaningful business." Or "Raising capital is selling your soul." Honestly, both are bullshit. They are just manifestations of people saying what was right for them is right for you.

Venture-backed ≠ equal venture scale

Bryce Roberts tweeted this. Simply put, just because you are venture-backed does not mean you have a venture-scale business. Separating those signals is important to managing growth of your business responsibly.

Non-venture-backed ≠ non-venture scale

Throughout Reforge, I haven't had a single hiring conversation where someone didn't ask why we hadn't raised money. The reality is that in our industry, many think that when a company isn't raising money, they aren't building a big business. Once again, bullshit. There are tons of examples of companies that built >$100M revenue companies before raising capital. Atlassian, Mailchimp, Lynda, Pluralsight, ipsy, Simplisafe, just to name a few.

Capital closes doors but also opens new ones

Capital closes doors. There's no way around it. It reduces exit options, life/company flexibility, growth plans. You don't raise capital to grow incrementally. And you can't fire your investors. But raising capital also opens new doors. You can fund new initiatives, take more risks, and more. Being clear on exactly what is being taken off the table and what is being put on the table is important to making the decision that is right for you.

Why did we decide to raise?

So back to the core question. Reforge is profitable, earns 8-figures in revenue, has cash in the bank, is growing YoY, and I owned (pre-financing) the majority of the company. Many people would look at that and wonder why in the world we would raise money? Let's go back to those first core questions:

What do we want to build?

As we built Reforge, we kept getting signals that the opportunity was larger at every turn. What we found is that most modern business knowledge is trapped in the heads of a select few. That knowledge can help grow careers, companies, and our industry. But traditional methods of MBAs, corporate training, and conferences weren't even coming close to solving the problem. Most importantly, we had figured out a way to solve and scale it.

On what timeline do we want to build it?

Once we realized the above, we decided we wanted to bring this to a larger audience at a much faster pace. We were uncovering frontier knowledge across a few new topics per year, but we will soon be doing it across 30+ topics and many major functions.

What resources do we need?

The timeline that we want to build this in dictated needing more people and capital than our cash flow would be able to fund.

What are the different ways to get those resources?

We explored a few different debt and equity financing options. We ultimately decided to raise from a16z for a few reasons. Andrew and I have a great pre-existing working relationship (super hard to find). The views of a16z align well with ours. The network that Reforge and a16z have built can create a 1+1=3 situation.

In the end, we had something we wanted to build, on a timeline our cash wouldn't fund and found the partner we wanted to do it with. The piece this doesn’t recognize is the personal side for founders and what it means for your life. But I’ll cover that in a future quick take. If you are interested in joining the team, we'd love to chat.

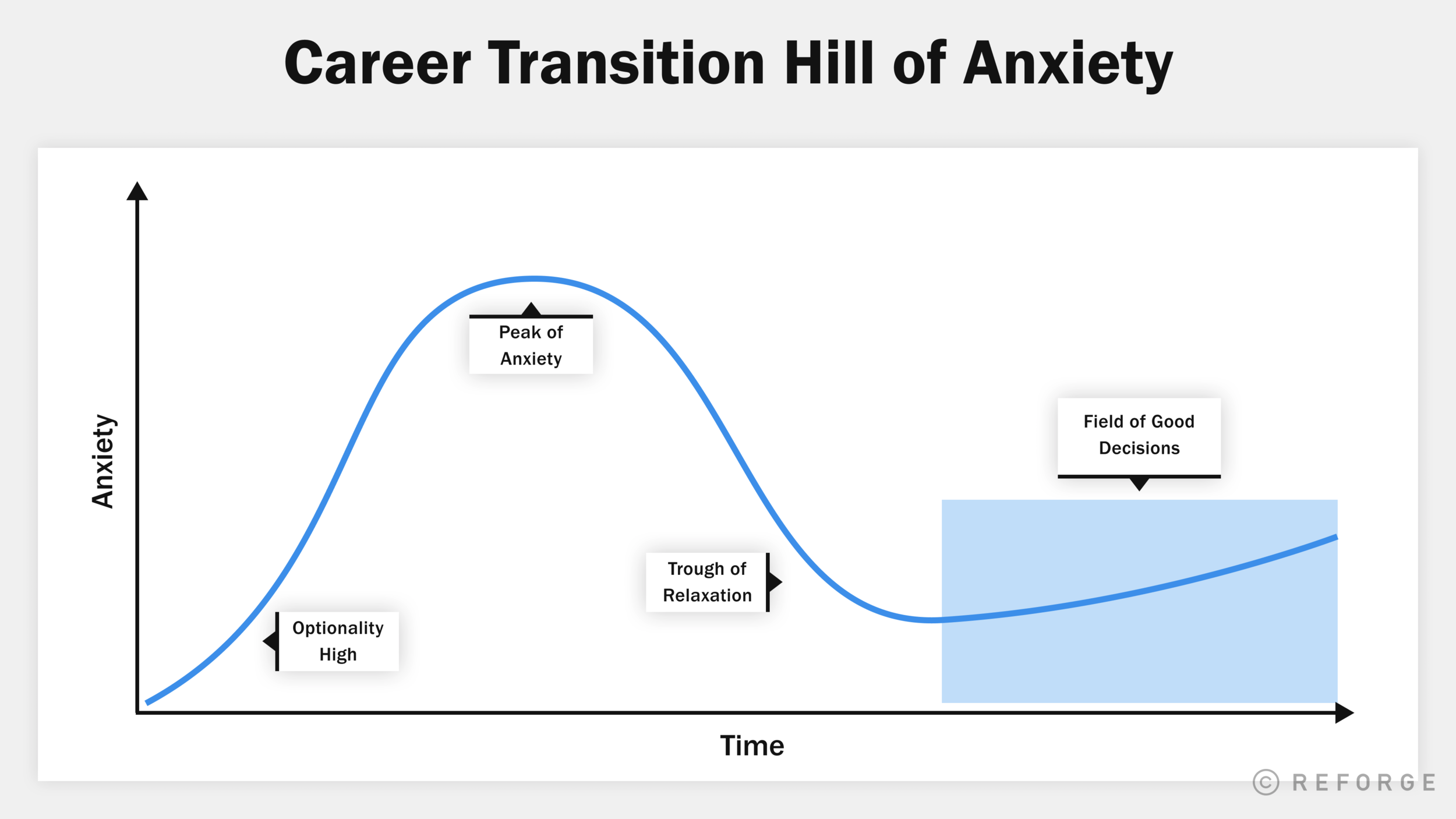

The Career Transition Hill of Anxiety

Throughout my career I've been through three major career transitions. In each of these transitions, I've sought out spending time with others also in transition. In some of these transitions, I've made great choices. In others, bad choices. I've also seen others do the same.

One thing I've noticed is what I call The Transition Hill of Anxiety. It helps explain where good and bad choices are made. Let's think about this as a graph:

Y-Axis: The amount of anxiety about what we should do next.

X-Axis: The amount of time we have been in transition.

Within this I think there are four stages:

The Optionality High

We leave our gig. At first, we have low anxiety. It feels incredible. "I can do anything!" The sea of options creates a ton of excitement.

The Peak of Anxiety

Some time passes. But our anxiety about finding what is next increases quickly. I think this happens for a few reasons:

The sea of options goes from creating excitement to creating anxiety. Making career decisions is hard. Those hard decisions create anxiety. Our inability to make the decision easily creates even more anxiety.

Operating in a high-growth tech company requires to be always-on. We need to direct that energy somewhere. When we don't have a place to direct that energy, that turns into anxiety.

The reality of no income (if you are taking time off) starts to become real, no matter how much you planned on it.

The "amazing" ideas we had before deciding to leave see some cold hard truth and don't look as great as they did before.

The problem is, a lot of career decisions are made at The Peak of Anxiety and where most of the bad decisions occur. The anxiety rushes us into roles or companies that were not a fit.

The Trough of Relaxation

If you are able to wait long enough you eventually push through the Peak of Anxiety and come back down to the Trough of Relaxation. This is where actual recharging takes place. Not in The Optionality High.

The Field of Good Decisions

Finally, the level of anxiety starts to creep up again, but more slowly than during the Peak of Anxiety. This time the stress takes the form of good stress. It is saying "I'm recharged, had time to consider a lot of options, and ready to get back into action." This is where I've made my best career decisions (HubSpot and Reforge) and seen others do the same.

Unfortunately, a lot of people aren't in a position to take the time needed to get past the Peak of Anxiety. That is why we created the Executive-In-Residence and Operator-In-Residence programs at Reforge.

Impact = Environment x Skills

Bangaly Kaba is a Reforge Partner and the former VP Product Growth at Instacart and Head of Growth at Instagram. During his time at Facebook, he managed a lot of Rotational Product Managers (RPM's). RPM's would do multiple 6-month stints in different parts of the org, then at the end of the rotation, they would choose a full-time placement.

At the end of their rotation with he would always have the same conversation:

How are you going to choose your next rotation?

How are you thinking about full-time placement after you finish your rotations?

After a number of these conversations, I realized many struggled with this and similar career decisions. To help solve this, he created a framework called: Impact = Environment x Skills

The framework states a few things:

Career progression is the result of the impact you create.

Impact is the product of your Environment and Skills.

Environment is the result of your Manager, Resources, Scope, Team, and Compensation

Skills break down into communication, influence, execution, and strategic thinking.

Bangaly says that evaluating each of these variables isn't about creating a spreadsheet that spits out the decision, but rather finding the most important variable so that you can focus on grappling with that piece.

Bangaly built out a step-by-step approach to using the framework. My three favorite points:

"One trap is thinking you just need to work on yourself in order to grow your career. But you are only one part of the equation. There is a whole other part of the equation, which is your environment. Your environment either limits or amplifies your own abilities. T***he variables of your environment are just as important as the variables of you***."

"It is the product of these variables, not the sum. At the highest level, if your skills are great but your environment is wrong, then you aren't set up for success. Or if your environment is great, but you don't have the skills to create impact, then you are also not set up for success. Looking at these variables as a sum misrepresents your true ability to create impact and drive outcomes."

"The most important advice I ever received was from Madhu Muthukumar, ex-Dir Product at Facebook and now Head of Product at Robinhood. He said "Invest as much time in storytelling as you do in execution." Great execution with poor communication limits your impact over time. You could be doing great work, but with out great communication then it won't receive the attention that it deserves.You need to embrace that communication is more influential than the other skill variables."

Shipping Big Product Bets

Andy Johns (ex-Wealthfront, Quora, Facebook) and Matt Greenberg (ex-Credit Karma) have shipped numerous big, complicated, high risk, high reward product bets. They say the dirty secret of Silicon Valley is that most great product teams follow a system that resembles waterfall (gasp!) to launch new innovative features/products repeatably. The system starts with high conviction based on judgment, intuition, and instinct rather than relying on iterative customer feedback to build conviction over time.

That is a little counter to the narrative around "Lean" and "Agile" that try to remove complexity through short development timelines and small iterations. But Matt and Andy make a good point:

"When creating and managing the system, the common tendency is try and remove complexity entirely. But this is impossible. There will always be a level of uncertainty involved in executing innovative and uncertain strategic ideas. Creating product-changing wins involves taking higher-risk, longer-term bets. Instead, you need to accept the uncertainty by building processes that manage complexity, increase conviction, and reduce risk over time."

Scaling product delivery is challenging because execution is very rarely a clean straight line. In practice, so many things can derail you on the path from strategic idea to outcome:

Uncertainty muddies what the path forward will entail - it's unclear how much time it will take to build, what you'll need to build, or what other dependencies you'll face.

Risks manifest that derail your efforts, such as facing a customer support constraint or losing access to a dependency team.

Misalignment occurs that can prevent you from moving forward.

Cannibalization is created because actions that you take in one area of the product have effects on other areas and can detract from one another.

The larger scale the project the more ambiguity there is in strategic decisions and tactical tradeoffs. Engineers especially are trained to find the "right" answer. Leaders get bogged down in trying to make the best decision but increase the time you spend on the wrong decisions. You've probably experienced a discussion similar to "This is 3% better than that." But the real discussion is, does this matter?

“High-performing product teams don't religiously subscribe to one tool for all problems. They recognize that through a company's lifetime, different problems arise that each requires a different tool.”

Matt and Andy created a Reforge program on Scaling Product Delivery for product and engineering leaders. You can join them in the upcoming Spring cohort.

Common Mistakes In Defining Metrics

This list is far from exhaustive, but these are the ones I see the most often:

Metrics before Strategy 🛒 🐴

Your metrics are a reflection of your strategy. They help answer, is the strategy working? Metrics with out strategy is like looking at a bunch of random numbers. You need to define the strategy before you define your metrics. What are the key hypotheses of the strategy? What metrics would indicate those hypotheses are true?

Definition Is More Important Than A Dashboard 📊

Most people focus on "building a dashboard." But what is 10X more important is choosing which metrics are important and defining ******those metrics well. Defining is more complicated than people think. For example, there are many ways to define a retention metric depending on your product. Your dashboard is a method to communicate your metrics, which is important, but useless if you choose and define poorly.

Outputs vs Inputs ℹ️

Most metrics like a retention metric or revenue metric are output metrics. These are metrics you should should monitor. Giving output metrics to teams as goals can be dangerous. They need to know how to break them down into input metrics to make them actionable. When this doesn't happen it leads to teams thrashing between things.

Usage First not Revenue First 💸

This is the most common version of outputs vs inputs. Usage creates revenue, revenue does not create usage. As a result the most important metrics in terms of creating growth are not your revenue metrics, they are your usage metrics.

Mixing Up Retention and Engagement 😕

I see a lot of teams think retention and engagement are the same things. They are not. Retention is binary. It answers the question, was this person active within my defined time period? Yes or no. Engagement is depth. It answers the question, how active were they within the defined timed period? 0→N. Engagement is one of three major inputs into driving retention.

Customers vs Users 👩💻

A customer and a user is not the same thing in most business models today. A customer is defined as the person/group that is paying you. A user is a person using the product. In subscription products, often times there are multiple users associated with a single customer. Or people are users before they are a customer. You need to separate the definition and language between these two things for teams to clearly act on them.

Related Reads: Why Most Analytics Efforts Fail

The Freemium Formula That Has Misled Many

Elena Verna (Reforge Partner, Ex SurveyMonkey, Miro, Netlify, MongoDB) has spent her career in freemium. I loved this post from her because it challenges some widespread thinking on freemium models.

The Old Way Of Thinking About Freemium

"Many companies still only consider freemium models if they think they will pay for themselves. They take an approach boiling down a freemium model's value down to four factors:

The cost of marketing and selling to a user in a paid model

The cost of serving a free user

The cost of acquiring a free user

How effective you are at converting users from free to paid

The problem is that this approach falsely assumes that only the direct monetization value from a freemium model should be considered.

How To Actually Think About The Value of Freemium

In addition to the above considerations, you need to account for the indirect growth value that freemium can provide. Elena says there are 6 things:

Higher Willingness to Pay - Potential buyers consciously or unconsciously evaluate if Purchase Price < Potential Value * Probability of Realizing Potential Value. Freemium can increase the probability of realizing potential value.

Increased Network Effects - Freemium can contribute to increase network effects such as the Data Network Effect Spotify has around discovery. NFX leads to increased acquisition, retention, and monetization.

Stronger User Habits - Free products allow users to develop a habit before they pay, creating not only more opportunities to convert but most importantly ensuring that customer retains.

Growth Loop Acceleration - Freemium can both enable product-led growth loops and accelerate existing ones where free trials and other models cannot.

Lower CAC - One of the more overlooked methods of indirect monetization is getting users into your product before they do in competitors and become more expensive to acquire.

Faster Product Insights - A larger, free user base can accelerate experimentation cycles and lead to more/better user insights for product decisions.