Why Product Market Fit Isn't Enough

I’ve been lucky to have been part of building, advising, or investing in 40+ tech companies in the past 10 years. Some $100M+ wins. Some, complete losses. Most end up in the middle.

One of my main observations is that there are certain companies where growth seems to come easily, like guiding a boulder down hill. These companies grow despite having organizational chaos, not executing the “best” growth practices, and missing low hanging fruit. I refer to these companies as Smooth Sailers - a little effort for lots of speed.

In other companies, growth feels much harder. It feels like pushing a boulder up hill. Despite executing the best growth practices, picking the low hanging fruit, and having a great team, they struggle to grow. I refer to these companies as Tugboats - a lot of effort for little speed.

What is the difference between these two types of companies? This is a question I’ve pondered for a long time and have pieced together a framework to explain the difference. The framework has many implications for how you seek out growth and build a company.

Before I explain the high level framework, we need to start with what the difference between these two types of companies isn’t...

It’s Not Just Great Product

The “go-to” answer for almost every question in startups, is “build a great product.” Every time I hear that answer it feels completely unsatisfied. Building a great product is a piece of the puzzle, but it’s far from the full picture.

- There are great products that never reach $100M+.

- There are also terrible products by many people's definition that reach far greater than $100M+. If you’ve ever used Workday, you know what I’m talking about. (At the time of this writing, Workday is worth $20 billion.)

"Build a great product" can't be the answer to most growth questions, if the above two statements are true. It is certainly a starting point, but not the answer.

The problem with the answer of “build a great product” is that it leads to something that Andrew Chen and I talk about extensively in the Reforge Growth Series called the Product Death Cycle. The Product Death Cycle was originally coined by David Bland of Precoil.

These are the phases of the product death cycle:

- Add New Features: Team adds new exciting product features.

- Launch: Features are launched with some press.

- Spike: A short term spike in growth occurs.

- Growth Flattens: Within weeks the growth flattens off.

- (repeat) Add New Features: Team ends up back where they started, adding new features to get another spike.

In terms of a growth curve, it looks similar to this:

This isn’t the type of curve we are looking for. Subscribing to the mantra that all you have to do is “build a great product” is submitting yourself to an “if you build, they will come mentality.” Happy dreaming.

It’s Not Just Product Market Fit

The second “go-to” answer is product market fit. While product market fit is a component of the framework, it is far from the answer. The issue with the product market fit mantra is that we have taken it to the extreme and developed tunnel vision. Statements like “Product Market fit is the only thing that matters” have become more common. It is not the only thing that matters.

There are plenty of companies that have all the product market fit signals (I’ll talk about these signals in the next post) but still struggle to grow, and definitely don’t reach a $100M+ product.

I’m lucky to be an investor in WonderSchool. Prior to pivoting to WonderSchool, the team developed Soldsie, a tool to help brands sell better on Instagram and Facebook. Soldsie has product market fit by all measures (solid NPS, good retention, organic growth), but despite great efforts, growth for Soldsie was slow, and the company was not growing at a venture-backed pace.

There are tons of similar examples in startup land. The main point is: product market fit is not the only thing that matters.

It’s Definitely Not Growth Hacking

One of the other common answers that has emerged is “Growth Hacking.” You have a great product, you have product market fit, now all you need is to find a growth hack to grease the growth wheels. No other term makes my stomach churn more.

While the term started with good intentions, it has morphed into a concept around hacktics - that there is a tip, trick, secret, or tool that is going to unlock growth in your business. The problem with hacktics are that they are short lived and never sustainable.

Before tactics you need a growth process. But before a growth process you need a strategy. This framework is all about how you construct your strategy and position yourself for "Smooth Sailer" growth.

What is the difference between Smooth Sailer and Tugboat companies?

It’s not great product, product/market fit, or growth hacking. Then what is it?

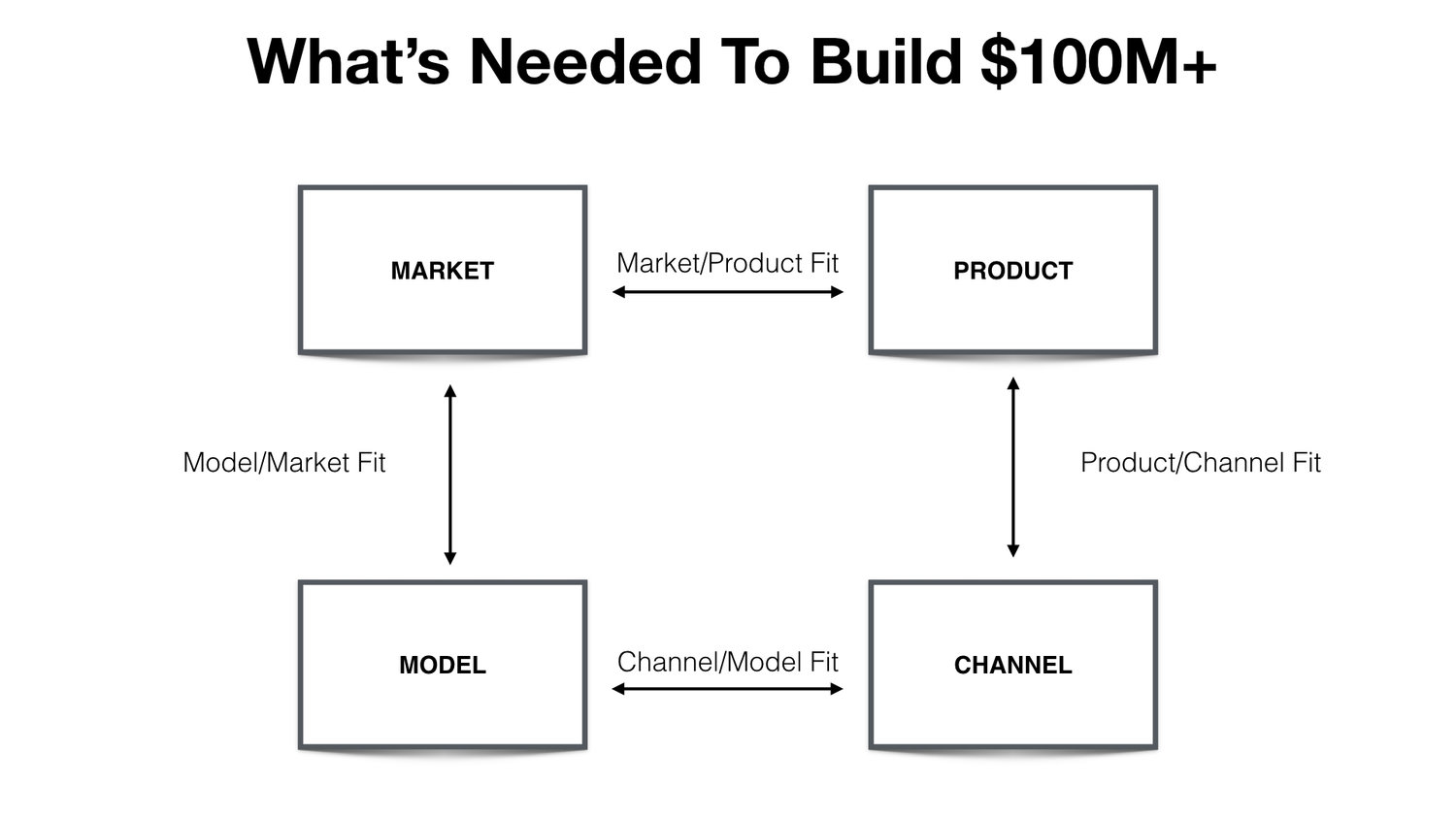

The difference between the $100M+ companies, and those that struggle are the ones that are able to make four pieces in a puzzle fit:

There are four essential fits: Market Product Fit, Product Channel Fit, Channel Model Fit, Model Market Fit. I'm going to dedicate a post to each of these fits, along with how you can apply this framework.

There are three extremely important points I want to hammer home through out these posts:

- You need to find four fits to grow to $100M+ company in a venture-backed time frame.

- Each of these fits influence each other, so you can’t think about them in isolation.

- The fits are always evolving/changing/breaking. When that happens, you can’t simply change one element, you have to revisit and potentially change them all.

I’m going to show you examples of the framework through my own failures and successes. The series will roughly go in this order:

- Market <> Product Fit

- Product <> Channel Fit

- Channel <> Model Fit

- Model <> Market Fit (coming soon)

- How The Four Fits Work Together (coming soon)

Market Product Fit

In the introduction to this series I made the point that Product Market fit is not the only thing that matters. It is actually only one of four fits needed to grow a product to $100M+ in a venture-backed time frame.

While Product Market Fit isn't the only thing that matters, it is important, so it makes sense that there are no shortage of blog posts explaining Product Market Fit, and how to get it.

Instead of echoing the many great Product Market Fit explainer posts out there, I'm going to focus on the 5 elements of Product Market Fit that I believe are most misunderstood and overlooked:

- The wrong way to search for Product Market Fit.

- Why we should be thinking about it as Market Product Fit.

- How we defined our market and product hypotheses for early versions of HubSpot Sales.

- What the search for market product fit looks like in reality, not just in theory.

- Qualitative, Quantitative, and Intuitive signals of market product fit.

In 2008 I co-founded a company called Viximo. We raised $5M out of the gate from top tier VCs to build a virtual goods platform (this was pre-Facebook platform days). I remember sitting in one of our first board meetings saying something similar to:

This probably seems like a reasonable statement to many (I hear it all the time in startup pitches), but there’s one serious problem with it. We had a solution (virtual goods platform) that was looking for a problem and a market (dating sites, social networks, etc.). In other words, we were putting the cart before the horse.

What we should have done instead was to focus on the problem and market, then search for the solution. This common mistake is why I prefer “Market Product Fit” over the terminology “Product Market Fit.”

The reason for this is because the real problem is something experienced within your market and by your audience, not something that lives within your product. While that phrasing might sound like a small change, language matters. How we word things affects how we think about things.

Searching For Market Product Fit The Right Way

When I got to HubSpot, I joined a brand new division in the company with just six other people. We were tasked with building the road to a second $100M line of business (the HubSpot Marketing product being the first), so it was a lot like running a startup within the larger Hubspot org.

Luckily, by this point I had learned my lesson from the Viximo days. Rather than focusing on the product first, we narrowed in on defining the market.

There were four key market elements that we looked at:

- Category. What category of products does the customer put you in?

- Who. Who is the target audience within the category? There are always multiple personas within a single category, so this breaks it down further.

- Problems. What problems does your target audience have related to the category?

- Motivations. What are the motivations behind those problems? Why are those problems important to your target audience?

While I find most companies really understand the “category” and the “who,” defining the problems and the motivations behind those problems is far more important.

Here is what these four elements roughly looked liked for our HubSpot division:

We explored multiple things in each bucket, but where we ultimately ended up the following combination of market elements:

- Category. Sales Software

- Who. The individual contributor. There were also two sub-types of ICs: SDRs and Account Reps.

- Problem. Not knowing where a prospect or client stood in the process.

- Motivation. A couple of motivations: 1) Money. Knowing where a prospect was led to better prioritization and selling which led to more closing. 2) Uncertainty. The target audience life was filled with constant uncertainty. Relieving that uncertainty was a big deal.

Out of this problem and market definition, the team started thinking about the product (solution). Through the awesome work of Christopher O’Donnell, Dan Wolchonok and a few others, they formed a really simple tool called Signals, which was then rebranded to Sidekick, and then rebranded again to HubSpot Sales (more on this later).

The product was extremely simple. It consisted of a Chrome extension that, with a click of a checkbox, let you track your emails and get instant notifications on who opened and clicked on your emails.

While this seems simple, back then our initial audience thought it was some voodoo magic. It helped solve that problem of knowing where their prospects stood. They now had an indication of where the prospect was -- if the prospect saw the email, if they clicked or viewed a proposal, if they forwarded it around their company, and more. The core product was free, with a $10 tier for unlimited notifications.

This brings us to the next group of elements in defining Market Product Fit -- the product hypotheses elements. The four main elements that were important to define as product hypotheses were:

- Core Value Prop. What was the core value prop of the product? How did it tie to the core problem?

- Hook. How could the core value prop be expressed in the simplest terms?

- Time To Value. How quickly could we get the target audience to experience value.

- Stickiness. How and why will customers stick around? What are the natural retention mechanisms of the product?

For the Signals product, the hypotheses looked like this:

- Core Value Prop. Understand what your prospects are doing and thinking, so you know how to sell better.

- Hook. See who opens and clicks on your emails.

- Time To Value. Quick (less than 1 minute). Install Extension -> Auth Email -> Send Test Email -> Get Notification. That instant notification demonstrates the value.

- Stickiness. High. Product only requires a user to keep checkbox checked to keep receiving notifications, and every notification reengages people with the product. With the Chrome Extension, we could also drop hints in the UI to further keep people engaged.

These hypotheses are extremely important to lay out. As you will see in future posts of the series, it informs and deeply affects the other components of the framework like Channel and Model.

Market Product Fit Is Not Binary

The iteration cycle of market product fit brings us to another key point:

Market Product Fit is not binary. It’s also not a single point in time.

A better way to think about Market Product Fit is on a spectrum of weak to strong.

When you imagine Market Product Fit as a binary concept, it implies that your market and product components don’t change. We know in practice, as in the Signals case, that this is far from the truth. Once again we should be letting the market lead the way in this ongoing process.

There are two primary ways that the market changes for a startup.

1. EXPANDING MARKET DEFINITION

Most startups start with a very niche market and expand the definition of their market outwards into larger and larger markets. Think of it like starting at the center of a bullseye and expanding out into concentric circular layers.

To expand into these concentric layers, the product typically needs to change to maintain the strength of market product fit.

Sometimes moving into these segments of a target audience are an iteration. Other times, they require much bigger changes. Understanding how big of a change is required starts with a deep understanding of the audience’s problems and motivations.

2. THE MARKET EVOLVES

At the same time, markets don’t sit still. That means the markets with which you have strong Market Product Fit will evolve over time.

For example, think about the shift from web to mobile. Facebook was one of the companies who successfully made the tough transition. Sheryl Sandberg has said that to do this, the company didn’t ship new features for a whole year just to make sure they nailed this market transition.

Signals Of Market Product Fit

If Market Product Fit isn’t binary, then how do you know if you have Market Product Fit? There has been a decent amount written about this, but most of it doesn’t reflect reality.

With almost everything, you need to combine qualitative measurements with quantitative measurements with your own intuition (link to other post). We trick ourselves when we only look at one of these areas. It’s a lot like trying to get a full picture of an object with only a one dimensional view.

How do we combine qualitative, quantitative and intuition indicators to understand how strong of Market Product Fit we have?

1. QUALITATIVE

The typical starting point with measuring Market Product Fit are qualitative indicators because they are the easiest to deploy and require the least amount of customers and data.

To get a qualitative understanding, my preference is to use Net Promoter Score (NPS). If you are truly solving the audience’s problem, then they should be willing to recommend your product to a friend.

The biggest downside with qualitative information (vs quantitative) is that it carries a higher probability for generating a false positive result, so take it with a grain of salt.

2. QUANTITATIVE

There are two quantitative measures to understand Market Product Fit: Retention Curves and Direct Traffic.

In 2013 I first spoke about how flat Retention Curves indicate Market Product Fit. So I won't rehash those points here.

There are some businesses where you can still have Market Product Fit with retention curves that aren’t flat. For example, an online dating product has natural churn built into success. A new insurance tech company where success for a customer is finding an insurance plan will also have natural churn built in. But for 80% of B2C and B2B products out there, flat retention curves is what you are looking for.

The second quantitative indicator is direct traffic. Direct traffic is typically the result of word of mouth. If you are truly solving an audience's problem, they tend to tell friends. It might not be a lot of direct traffic, but there should be some.

The two combined (flat retention curves and direct traffic) mean that a product with Market Product fit will grow naturally without additional efforts like paid marketing.

Sometimes I like to ask the question, “If you turned off all your marketing efforts today, would you keep growing?” The answer should be yes. The growth might be slow, but it should still be naturally growing.

3. INTUITION

Intuition is about gut feeling, and it’s hard to verbalize. It’s hard to understand intuitively if you have Market Product Fit unless you’ve been part of some situations where you don’t have it and some situations where you do have it. I’ve been in both situations. So has Peter Reinhardt, founder/CEO of Segment, who I think has had the best description of how Market Product Fit feels:

“Product market fit doesn't feel like vague idle interest. It doesn't feel like a glimmer of hope from some earlier conversation. It doesn't feel like a trickle of people signing up. It really feels like everything in your business has gone totally haywire. There's a big rush of adrenaline from customers starting to adopt it and ripping it out of your hands. It feels like the market is dragging you forward.

I think the Dropbox founders said this best that product market fit feels like stepping on a landmine...when we did find product market fit, I thought for sure, this is too tiny to matter but it actually solved a real problem and the market demanded it and ripped it out of our hands.”

The point here is when you have strong Market Product Fit, it feels like the market is pulling you forward vs you pushing something on the market.

The Key Points

- Start with the market (problem), then the product (solution). Not the other way around.

- Define your market hypothesis using Category, Who, Problems, Motivations with most of your work going into Problems/Motivations.

- Define your product hypothesis using Core Value Prop, Hook, Time To Value, Stickiness.

- Think of Market Product fit as a cycle.

- Understand that Market Product fit is not binary. Instead, it’s a spectrum of weak to strong.

- To understand if you have Market Product Fit, combine the qualitative, quantitative and intuitive indicators.

Product Channel Fit

This is part three in a series about 4 Frameworks To Grow To $100M+. Subscribe to get the rest of the series

In the introduction I explained there are two types of companies:

- Tugboats, where growth feels like you have to put a ton of fuel in to get only a little speed out.

- Smooth sailors, where growth feels like wind is at your back.

The difference between these two are not the common mantras of build a great product, product market fit is the only thing that matters, or growth hacking.

In part two, I talked about why we should think about Product Market Fit as Market Product Fit, how to lay out your Market and Product hypotheses, and how understanding whether you have Market Product Fit comes down to Qualitative, Quantitative, and Intuitive indicators.

Which brings us to part three: Product Channel Fit.

Earlier, I discussed our common obsession with Product Market Fit that has led to false beliefs such as “Product Market Fit is the only thing that matters.” A byproduct of that false belief are statements such as:

“We are focused on product-market fit right now. Once we have that we’ll test a bunch of different channels.”

There are two major issues with this statement. I’ll break them down separately.

1. Products Are Built To Fit Channels, Not The Other Way Around

The first issue with that statement is that it is saying that channels will mold to the product you are building and as a result you think about product and channel separately in silos. But if you think about your product and channels in silos, then you will end up trying to fit a square peg through a round hole. Why? Because…

Products are built to fit with channels. Channels do not mold to products.

Let that statement sink in for a second because it is an important one.

Products are built to fit with channels, not the other way around. The reason for this is that you do not define the rules of the channel. The channel defines the rule of the channel.

- Facebook defines the rules of what content and feed items appear in people’s feeds. They also define what is allowed via their API’s. They also define which ads get shown and how expensive they are.

- Google defines what content appears in the top ten search results. They also control what the top ten search results look like. They determine what ads appear and the rules that govern their cost.

- Email clients such as Gmail determine what is spam, what ends up in the promo box, and what the content format is allowed in emails.

We could run through this for every major distribution channel out there.

You control your product, you do not control the channel. So you need to change the things within your control to fit with the things that you do not control.

What are some general elements of products that fit with different categories of channels:

- Virality. For virality to be a high ceiling channel, a product at a minimum needs

- Quick Time To Value. Virality thrives when the viral cycles are short.

- Broad Value Prop. Value prop of the product needs to be applicable to large percentage of a user's network (branching factor).

- Network Makes Product Better. Ideally the product value increases the more of your network is on it.

- Paid Marketing. To have product channel fit with paid marketing:

- Quick Time To Value - Users have less patience to find value when coming from an ad.

- Medium to Broad Value Prop - Value prop needs to be fairly broad due to targeting constraints of ad channels.

- Transactional Model - Product is built to extract transactional value to fund paid marketing.

- UGC SEO. To have product channel fit with UGC SEO:

- UGC - Product needs to enable users creating millions of pieces of unique content.

- Motivation to Contribute - Product needs to have the core motivation to contribute content.

2. The Power Law of Distribution

The second problem with that original statement is “we’ll test a bunch of different channels.”

In his book, Zero To One, Peter Thiel pointed out why this is wrong:

“The kitchen sink approach doesn’t work. Most companies get zero distribution channels to work. If you get just one channel to work you have a great business. If you try for several but don’t nail one, you’re finished. Distribution follows the power law."

That last part is key - “distribution follows the power law.” In other words, at a given moment in time a company that has product channel fit will get 70%+ of their growth from one channel.

Subscribe to Get More of My Essays on Growth

If you look at most $100M+ companies, you will find this to be true:

- UGC SEO: TripAdvisor, Yelp, Glassdoor, Pinterest, Houzz all got 70% of their growth from UGC SEO.

- Virality: WhatsApp, Evernote, Dropbox, Slack all got 70%+ of their growth from some form of virality.

- Paid Marketing: Supercell, Squarespace, Blue Apron all got 70%+ of their growth from some form of paid marketing.

The power law of distribution exists because of the concept of product channel fit. Companies that are able to achieve product channel fit with multiple channels are rare, but end up being monsters. LinkedIn is the perfect example where over time they've achieve Product Channel Fit with Virality, UGC SEO, and different forms of Inbound and Outbound Sales.

Product Channel Fit

Product Channel Fit when your product attributes are molded to fit with a specific distribution channel. As a result you can't think about Product and Channel as silos.

Product Channel Fit has a few immediate implications:

1. You shouldn’t take a shotgun approach to testing channels.

It is better to prioritize and tackle one or two at a time in pursuit of your power law channel. Here is a step by step on how to test and prioritize your growth channels.

2. Over time you shouldn’t seek to diversify channels for the purpose of diversification.

You should seek out other channels in case product channel fit breaks and need to transition to a new one (more on this below).

3. Don't have team members focused on user acquisition and team members focused on product in silos from each other.

This is partly why cross functional growth teams have emerged.

Product Channel Fit Is Your Blessing and Your Demise

You know the saying that your strength is also your biggest weakness? Well that applies to Product Channel Fit. Product Channel Fit is what can make your company, and also what can kill it.

The reason is because Product Channel Fit (just like all the other fits) is always evolving and can break as a new channel emerges or an old channel gets killed off. Let’s look at examples of both.

1. New Channels Emerge

Every so often a new major channel emerges in the ecosystem. When this happens you typically see two things:

- Companies in the old channel will try and copy/paste their product into the new channel.

- Because of Product Channel Fit, #1 doesn’t work and leaves the door open for new companies to emerge.

There has been no clearer example of this than the gaming industry.

In the early 2000’s desktop web portals were the major channel. You had big flash gaming companies emerge like PopCap. Then in early 2007, social emerged as a new channel with the Facebook platform. The flash web gaming companies tried to just copy/paste their games into the new channel and it didn’t work. They left the door open for companies like Zynga and Playdom to emerge and build products that fit with the new channel.

Then a few years later mobile emerged as a new channel. Zynga tried to copy/paste their popular games into mobile which didn’t work. The door was open for companies like Supercell to emerge who built new products to fit with the new channel.

Zynga, PopCap, King, etc are still around today. But they took a really long time to transition to the new channels correctly and as a result some opportunity was captured by others.

This hasn’t just happened with gaming. Online Dating is another category where there are tons of examples:

Match and others emerged during the first web boom and got most of their traction via banner ads. Then SEO emerged as a major channel and PlentyOfFish emerged as a contender. Then the social platforms came along and Zoosk and others emerged. Then mobile came along and Tinder emerged.

All along the way the same thing happened. New channel emerges, old player tries to copy/paste, opens door for new company/product to emerge with Product Channel Fit with the new channel.

This is worth repeating here. Products need to be molded to the channel. The channel does not mold to the product. Product Channel Fit creates new companies. But if not managed properly, can also kill your company.

1. Old Channels Get Killed Off

In late 2011 Pinterest hit an inflection point and their growth started to take off. One of the reasons were they hit product channel fit. The channel was viral sharing to Facebook's feed through their API. But around end of 2012 Facebook started killing off the API's that enabled this channel. Many reported on Pinterest's slowing growth.

This is an example of when you have Product Channel Fit, but it breaks due to a channel getting killed off. Many companies were also effected by Facebook killing off this channel. Pinterest was one of the few that transitioned successfully. They ended up transitioning to a UGC SEO channel which has driven their growth ever since.

Part of that transition over the long term was that Pinterest also changed their product focus from a social product to more of a personal utility. Once again, you have to mold the product to the channel. You can't think about them in silos.

In the next two posts in the series we'll go through the other two frameworks Model Channel Fit and Model Market Fit.

After that we will bring all four frameworks together and put them into action. Subscribe to get the next posts in the series.